-

American Presidents

List of United States Presidents Categories: America, presidential history, Tags: presidents of the united states of america, who were the presidents 18th Century1. George Washington2. John Adams 19th Century3. Thomas Jefferson4. James Madison5. James Monroe6. John Quincy Adams7. Andrew Jackson8. Martin Van Buren9. William Henry Harrison10. John Tyler11. James K. Polk12. Zachary Taylor13. Millard Fillmore14. Franklin Pierce15. James Buchanan16. Abraham Lincoln17. Andrew Johnson18. Ulysses S. Grant19. Rutherford B. Hayes20. James Garfield21. Chester A. Arthur22. Grover Cleveland23. Benjamin Harrison24. Grover Cleveland25. William McKinley 20th Century26. Theodore Roosevelt27. William Howard Taft28. Woodrow Wilson29. Warren G. Harding30. Calvin Coolidge31. Herbert Hoover32. Franklin D. Roosevelt33. Harry S. Truman34. Dwight D. Eisenhower35. John F. Kennedy36.…

-

The Queen, Elizabeth Alexandra Mary, Was Born

A Queen Is Born On April 21, 1926, the Duke and Duchess of York (later King George VI and Queen Elizabeth, the Queen Mother) welcomed their daughter Elizabeth Alexandra Mary to the world. Shortly after, the family was photographed with baby Elizabeth cloaked in a christening robe that had been in the royal family for generations.

-

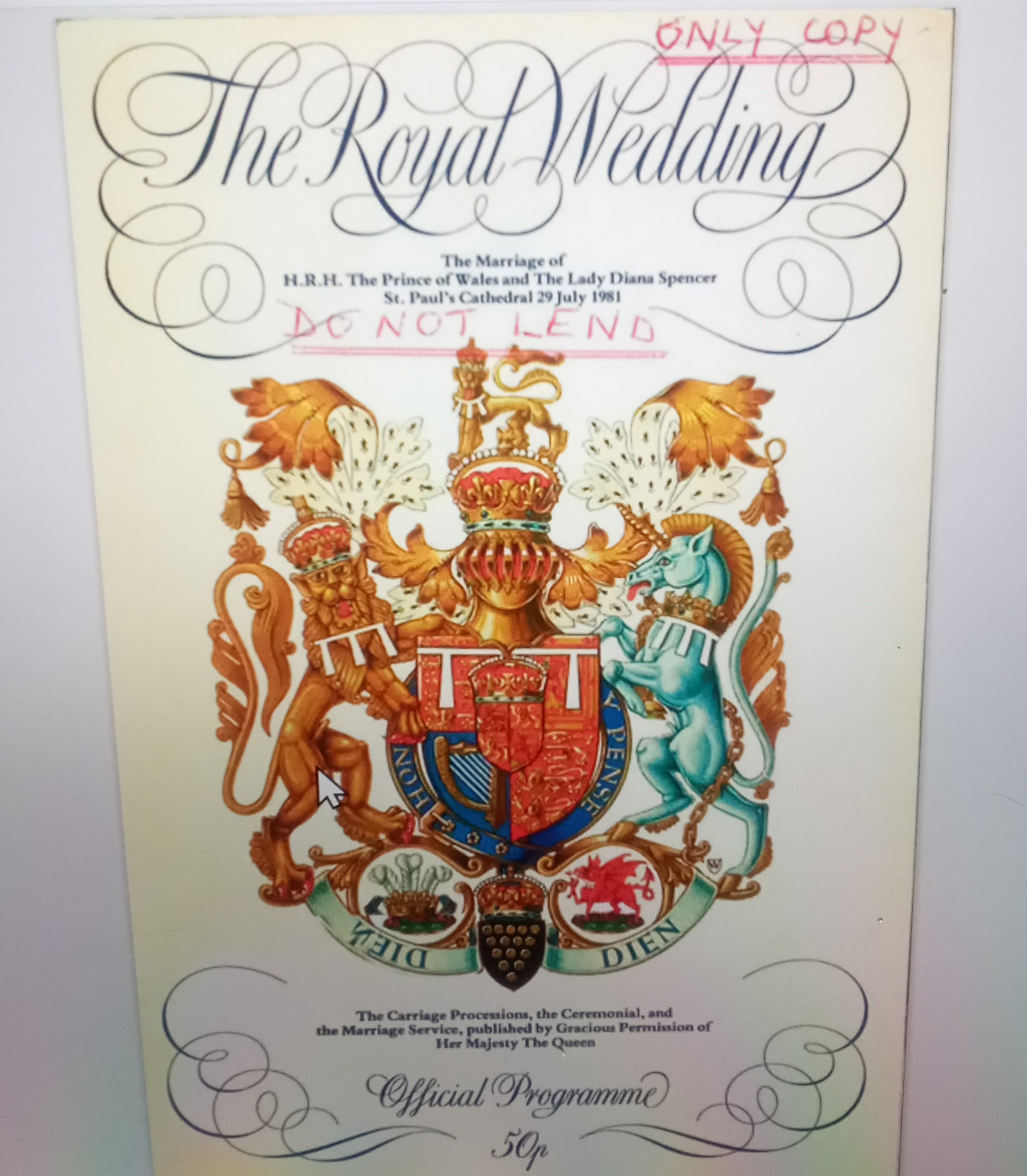

Royal Wedding

Wedding program for Prince Charles and Diana.pdf Prince Charles of Wales and Lady Diana Spencer’s royal wedding ceremony took place on July 29, 1981. Royal Programme, a detailed, 25-page script of the day, for 50 pence, the cost at that time.

-

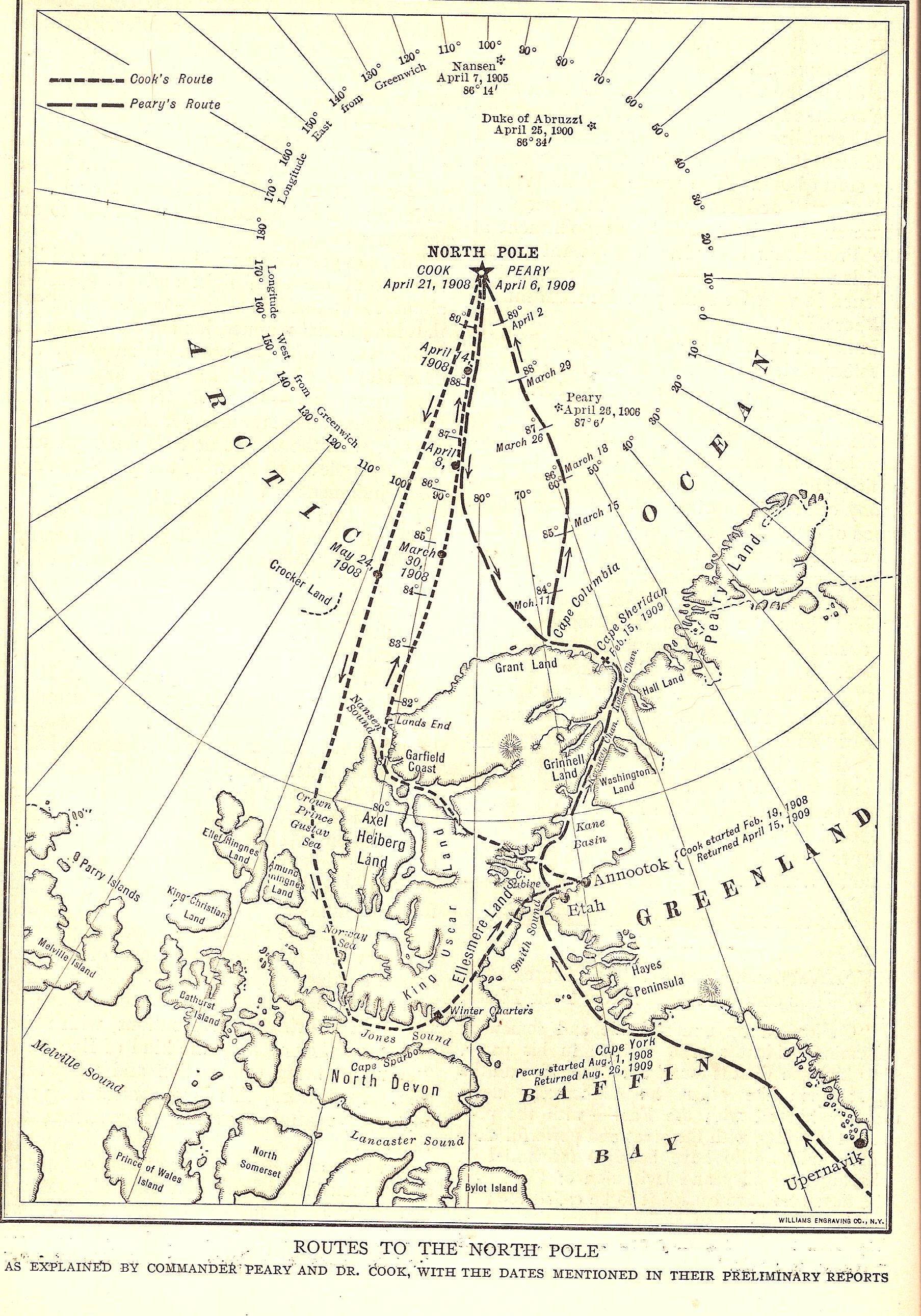

Discovery of the North Pole

There is controversy over who the true discoverer of the North Pole really is. There is no doubt, however, that Frederick Albert Cook (June 10, 1865 – August 5, 1940) American explorer and physician, along with another American explorer, Robert Edwin Peary, Sr. (May 6, 1856 – February 20, 1920), both claimed (though separately achieved) to have reached the ultimate unconquered destination of the era; the frozen unknown at the geographic north point of the Earth’s axis of rotation, where children imagine Santa Claus lives. (A caveat is not to confuse geographic north with magnetic north). We are referring to the discovery of geographic north. Featured the detailed map showing Cook…

-

The Iron Curtain

Map of Iron Curtain