History Lesson in Investing

INVESTING

- FEBRUARY 19, 2012

Retro Investing—Look Back to Get Ahead

By TOM LAURICELLA

Break out the poodle skirts and crank up the Perry Como.

It’s often said that investors these days are navigating uncharted territory. The world’s major economies are swamped by massive amounts of debt, the Federal Reserve has essentially locked interest rates at zero and the outlook for corporate profits is increasingly cloudy.

Many investors are paralyzed by this environment, which is unlike anything they have seen in their adult lives. As a result, they’re hunkering down in cash and super-safe government bonds. However, as is often the case, investors can look to the past and find potential guideposts for building a portfolio for today’s markets.

In this case, history suggests that stocks with higher dividends could be in for a long period of healthy returns. Looking at the broad stock market, history suggests stocks in general could struggle compared with government bonds as long as rates are capped by the Fed, which is contrary to the conventional wisdom today. But for the longer term, stocks are a better bet than bonds.

For their history lesson, investors should set their wayback machines to the period beginning in the late 1940s. It was a time when bond-market interest rates didn’t float freely as they usually do, but instead were capped by the government at low levels to help the country manage the enormous debts accumulated during World War II.

Economists have a gloomy sounding term for when bond-market rates are explicitly or implicitly capped below the rate of inflation. It’s called “financial repression.”

Today, the Fed is engaged in a similar push. It’s been buying trillions of dollars of bonds in an effort to keep market rates low to help repair the economy. The Fed has said it expects to keep interest rates near zero until late 2014.

Barry Knapp, head of U.S. equity portfolio strategy at Barclays Capital, has studied this period and the period after the Fed loosened the reins on rates in 1951.

Low Interest Rates

For the post-war period in which the Fed capped rates, as is the case today, investors earned meager yields. At the time, the Fed was keeping rates just north of 1%, a level which was below inflation.

It’s worth noting, though, that by keeping rates from rising, the Fed also kept bond prices from falling. “The yield cap meant prices couldn’t go anywhere,” says Mr. Knapp.

Meanwhile, stock prices struggled during that period. Conventional wisdom in the markets these days is that extremely low government-bond yields force investors to move their money to riskier investments, such as stocks. But, says Mr. Knapp, “that’s not what happens until [bond] prices return to normal.”

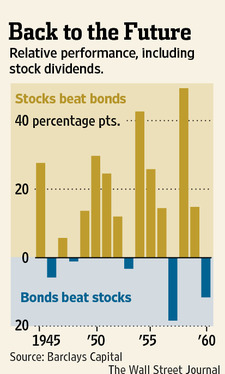

As was the case in 2011, during the late 1940s stocks generally suffered from a decline in price/earnings ratios, which reflected less willingness of investors to pay for future growth of corporate earnings. In 1948, government bonds posted returns 1.1% percentage points greater than stock returns when dividends are included, according to Barclays.

Bonds were for the most part a better investment than stocks until the Fed lifted the cap on rates in 1951. That year the tide reversed and stocks outperformed bonds by 25 percentage points, according to Barclays. Aside from recession years, that trend of outperformance by stocks continued over the course of the decade. (It was 1954, incidentally, when the Dow Jones Industrial Average finally regained its pre-1929-crash level.)

The downside to investing in bonds when yields are capped became clear when the caps were lifted: rising yields pushed down prices on exisiting bonds.

“Investors can’t just invest in Treasurys and expect a return in excess of inflation,” says Jason Trennert, chief investment strategist at Strategas Research Partners.

In early 1951, the real yield on long-term U.S. Treasurys—which measures the yield minus inflation—was around negative 6.5%, according to Strategas.

More Risk, More Income

In that environment, investors “have to take more risk to achieve returns that are better than inflation and equities wind up being the most natural choice,” says Mr. Trennert. Today, yields aren’t as deeply negative, but bond holders are still losing money compared to inflation. Today, the real yield on long-term U.S. Treasurys is a negative 0.6%, according to Strategas.

Throughout the 1940s and ’50s, high-yield dividend stocks offered the best returns for stock investors. In the 1940s, dividends comprised 74% of the total returns investors earned on stocks and 40% for the 1950s, according to Strategas.

The greatest outperformance for the highest yielding stocks came during the periods when real interest rates were at their most negative. “The highest yielders outperformed…when we were in the most intense phase of financial repression,” says Barclays’s Mr. Knapp.

Dividends subsequently fell out of fashion for many decades. But now, with interest rates low and economic growth expected to be subdued for the next couple of years, dividends are coming back in vogue.

Dividends provide the comfort of an income stream and cushion against falling stock prices. And dividend stocks often have higher growth rates than nondividend stocks, says Mr. Trennert. “The theory is that the discipline of having to pay a dividend generally helps companies avoid bad mistakes,” he says.

For investors adding dividends, A. Michael Lipper, president of Lipper Advisory Services in Summit, N.J., warns against simply adding the stocks that have high dividends compared to their prices. Instead, investors may want to focus on strategies aimed at finding companies that will raise their dividends, he says.

Among individual stocks, Mr. Lipper points to payroll company Automatic Data Processing (ADP) and news and data company Thomson Reuters (TRI). “They both have a long history of bumping up the dividend each year,” he says.

For mutual-fund investors, he likes Vanguard Dividend Growth (VDIGX) or Franklin Rising Dividends (FRDPX). For those looking for non-U.S.-focused funds, he suggests Matthews Asia Dividend (MAPIX).

Write to Tom Lauricella at tom.lauricella@wsj.com